What’s the best way to pay down a credit card balance as quickly as possible, while paying the least in interest, and without hurting your credit? What follows is a powerful method recommended by the most astute personal finance experts to achieve exactly those objectives. It’s extremely effective, completely legal, and leverages programs created by credit card issuers to your advantage. Follow these steps and start to become credit card debt-free.

What’s the best way to pay down a credit card balance as quickly as possible, while paying the least in interest, and without hurting your credit? What follows is a powerful method recommended by the most astute personal finance experts to achieve exactly those objectives. It’s extremely effective, completely legal, and leverages programs created by credit card issuers to your advantage. Follow these steps and start to become credit card debt-free.

Step 1: Use A Powerful Tool To Immediately Stop Paying Interest On Your Balance

Think of someone carrying a credit card balance like a patient who enters an emergency room bleeding badly. The first thing a doctor will do is stop the bleeding. It’s no different when attacking a credit card balance; the first thing you do is stop the interest charges.

There’s a simple way to do this, and it’s brilliance is that it actually uses the banks’ marketing offers to your advantage: find a card offering a long “0% intro APR balance transfer” promotional offer, and transfer your balance to it. These are cards which offer new customers a long period of time (often as much as 18 months) during which the card charges no interest on all balances transferred to it. We constantly track all the cards in the marketplace in order to find the ones currently offering the longest 0% intro periods.

If you need more motivation, just think of this: on a $10,000 balance, $150 of a $200 monthly payment would get vacuumed up by interest charges.* That leaves only $50 of your $200 that actually reduces your balance, the rest vanishing into bank pockets. That’s just brutal. Use our reviews to find a card which offers the longest possible no-interest period while charging low, or even no fees. Moving your balances to the card you choose will stop the bleeding, allowing you to move on to step two.

Step 2: Power Through Your Balance During The 0% Period.

Once you’ve transferred your balances and put a stop to the interest charges, it’s time to capitalize on the interest-free period to really break free of the debt. The best part of this is how simple it is: just keep making the payments you used to make when you had to pay big interest payments, except now 100% of your payment will go to reduce your balance.

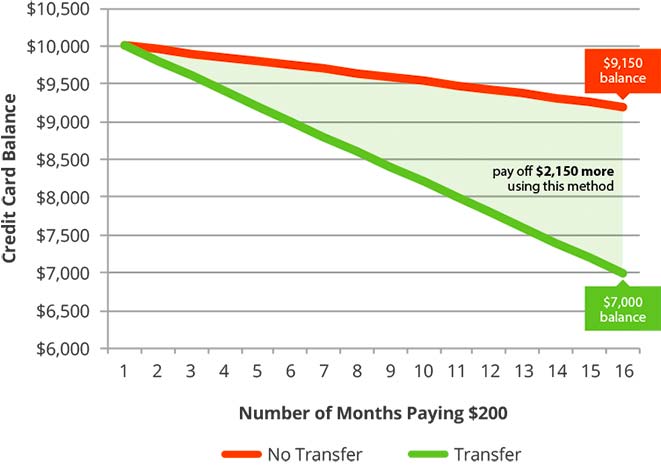

Going back to the $10,000 example above. (just be aware that we’re using the $10,000 number as an example to demonstrate how the process works. You may be approved to transfer an amount greater or less than $10,000). If you transferred that balance onto a card which offers 15 months of 0% intro APR with no transfer fee, and maintained the same $200 monthly payment, you can see how much faster you’ll be reducing your balance in the chart below.

As you can see, without using the 0% card, the same $200 monthly payments barely make any headway. It’s like swimming upstream, or walking while taking a step back for every two steps forward. That’s no way to swim or walk, and attempting to pay off your cards while paying high card interest rates is no way to manage your finances. Move your balances onto one of the cards below, stop getting crushed by interest, and start making real progress toward getting rid of your card debt.

Top 0% Intro APR Balance Transfer Cards:

Discover it® Cash Back

When it comes to cash-back credit cards the Discover it® Cash Back is in a league of its own. Not only can you earn generous cash back rewards, this card comes with long 0% intro APR on balance transfers and purchases.

Transfer your high-interest balance to this card with intro APR

0% for 14 months then 11.99% – 22.99% Variable.

Earn 5% cash back on everyday purchases at different places each quarter like grocery stores, restaurants, gas stations, select rideshares and online shopping, up to the quarterly maximum when you activate. Plus, earn unlimited 1% cash back on all other purchases – automatically. Then, Discover will match ALL the cash back you’ve earned at the end of your first year, automatically. There’s no signing up. And no limit to how much is matched. That means, if you earn $300 in cash back in your first year, Discover will match it, making your total cash back for the year $600! Log into your Discover account each quarter to activate the 5% cash-back bonus. Finance purchases with intro APR 0% for 14 months then, 11.99% – 22.99% Variable after that. Get all this for $0 annual fee.

The Verdict: With your first-year sign-up bonus, take home an incredible 10% cash back on category spending.

Most Appropriate For: If you want long 0% intro APR and if you buy things at gas stations, wholesale clubs, grocery stores, restaurants and Amazon.com.

Credit Required: Excellent/Good

Discover it® chrome

Over a year of 0% interest on purchases and balance transfers! High cash rewards at gas stations and restaurants AND no annual fee makes this card offer special.

The Discover it® chrome credit card comes with everything you wish all credit cards came with – no annual fee, no foreign transaction fees, no overlimit fee, and a free pass the first time you miss a payment! Cardholders also get an intro APR of 0% for 14 months on both purchases and balance transfers, then 11.99% – 22.99% Variable. If you misplace your credit card, freeze your account in seconds with an on/off switch on the mobile app and website. No late fee on first late payment. No foreign transaction fees. Free FICO® Credit Score. $0 Fraud Liability. Redeem your rewards for cash in any amount, at any time and your cash back never expires. That means extra cash in your pocket to spend any way you want. Plus, Discover will match ALL the cash back you’ve earned at the end of your first year, automatically. There’s no signing up. And no limit to how much is matched. The list of features seems endless on this Discover card.

The Verdict: This is a great choice if you want to consolidate debt, make a large purchase or eat out often. Discover will reward you with the ability to earn 2% cash back at gas stations and restaurants on up to $1,000 in combined purchases each quarter. plus, earn unlimited 1% cash back on all other purchases – automatically.

Most Appropriate For: People who like to earn cash back with no annual fee and lengthy APR offers.

Credit Required: Excellent/Good

* Savings calculation: Credit Card Balance * (1+Average Card Rate/365)^639 days – Balance Transfer Fee – Average Household Credit Card Balance Balance transfer fee is minimum of 3% or $10. Monthly interest calculated on $10k balance at 18% as: 10000*(1+(0.18/360))^365-10000)/12

*Editorial Note: This content is not provided or commissioned by the credit card issuer. Any opinions, analyses, reviews or recommendations expressed in this article are those of the author’s alone, and may not have been reviewed, approved or otherwise endorsed by the credit card issuer. This site may be compensated through a credit card issuer partnership.